Impact Finance

RAZFinance.io

Tracks and verifies impact

Engages teams and stakeholders to verify outcomes

Manages capital allocation decisions

Increases the speed and efficiency of due diligence

The RAZ Experience

Claims related to social or environmental problem-solving, ESG initiative implementation, and resulting financial performance are validated through a streamlined data management process.

Data

Action steps towards the realization of specific initiatives that substantiate capital allocation decisions are uploaded onto the platform. Timelines, proof points and verification events are associated with a blockchain ledger.

Verification

ESG, impact, sustainability and financial data data, project action points and reports are verified by stakeholders. Each project can choose who to engage, and whether to include the RAZ community and the public.

Our Audience

Investors, Fund Managers and Donors

RAZ answers:

- How is our capital and funding being deployed?

- Is progress being made according to our impact, sustainability and ESG goals genuine?

- How do we prove that our short-term goals and outcomes have been achieved?

- Where do we find genuine impact, ESG and sustainability investment opportunities? How do we find more reliable projects to deploy philanthropic capital towards?

Companies and Organizations

RAZ provides:

- Transparent due diligence and access to a wider audience of potential investors and donors

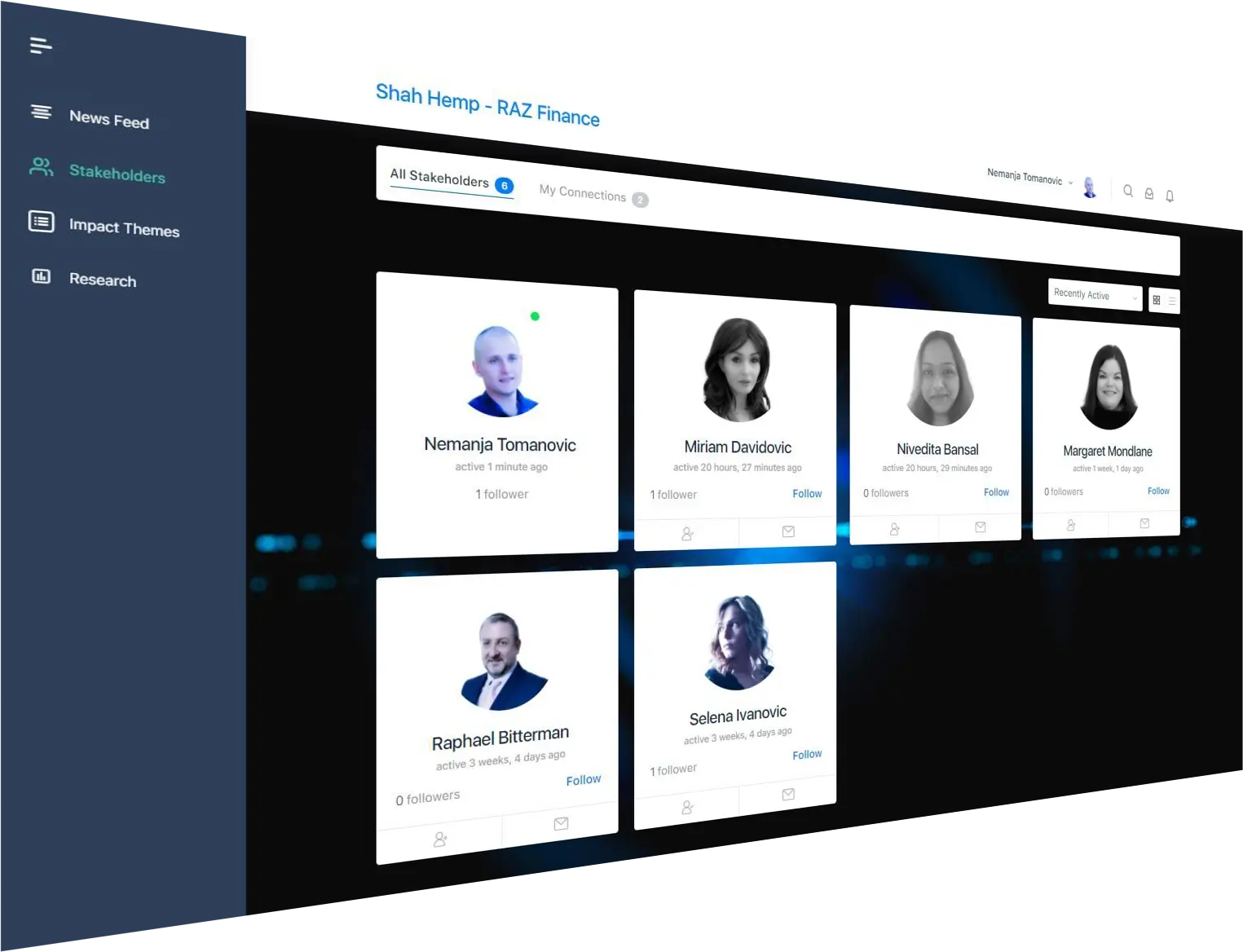

- The ability to engage stakeholders as part of realizing and verifying outcomes

- Stakeholder and community engagement with progress related to “impact in action” that leads to increased data credibility.

- The ability for high-potential companies, initiatives and organizations across the world to prove their positive impact in action and access aligned funding.

Where We Are Now

Project Owners retain control over the usage of, and access to, their data.

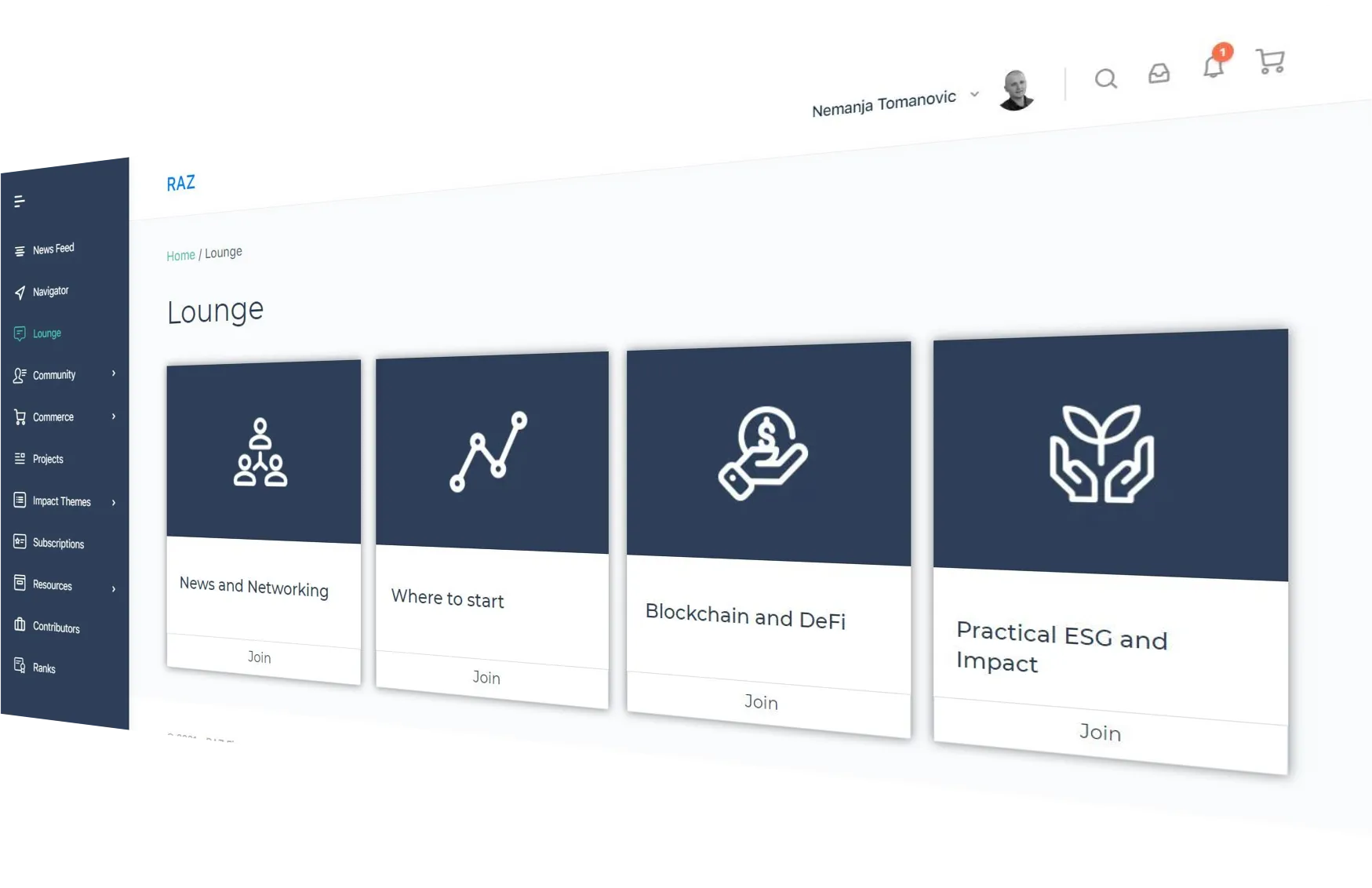

Impact Themes and Initiatives are customized according to the goals of project owners. Dashboards facilitate data tracking and stakeholder engagement.

Action steps, progress and capital deployment towards the realization of economic, social, environmental and governance outcomes can be verified.

Stakeholders, including: investors, team members, employees, suppliers, customers, verification experts and intended beneficiaries can verify and influence outcomes

Actions and results are recorded while unfolding, as a digital “time capsule”on the Tezos blockchain

Confidential and proprietary data is stored off-chain through decentralized solutions

Project Owners maintain control and ownership over their data, and can set access levels for their projects, inclusive of:

Publicly viewable

Accessible to the $RAZ community and open for feedback

Limited to the project’s stakeholders

Datasets from our project’s development process are tokenized through OCEAN ERC-20 datatokens and traded through the Ocean Market as Impact in Action PHEORC-5 and Decentralized Impact | Finance | Evolved

Development Journey and Network Integration: Where We Want to Be

RAZ becomes a fully decentralized network platform

Data is associated with stakeholders' decentralized identifiers

The RAZ process transforms economic, social, environmental and governance data into digital assets

Off-chain data is bridged to a diverse range of blockchains via oracle solutions and smart contracts

Capital is deployed to projects across the RAZ network through our token staking and treasury funding mechanism

Impact is correlated to resulting revenue across the timeline of the project or investment

Financial and impact reporting become integrated through data science, artificial intelligence and machine learning

RAZ launches a secondary exchange that facilitates due diligence, capital deployment and liquidity across the landscape of ESG, impact and sustainable investing

The Future of Impact Finance

RAZ + ixo

The ixo Impact Exchange platform (DEX) for swapping pairs of fungible token assets, including RAZ, from any Internet of Impact network zone and will connect through to the Cosmos Hub DEX to access cross-network liquidity. The RAZ team has joined the ixo Launchpad program and is in the process of qualifying to become an Impact Market Relayer in order to connect RAZ data management solutions and integrated impact-financial outcome management with the Internet of Impact.